Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In the complex modern lending industry, supplemented as it is with vendors and investors, institutions that service customer loans regularly need to provide third-party users with access to pertinent loan information. During the carefree innocence of February 2019, we introduced the Investor Portal app as the GOLDPoint Systems method for addressing this need.

Over the last 4 years, however, the app has evolved and expanded so much that we thought it would be a good idea to revisit and reintroduce it. The new and improved Loan Portal app has been overhauled with more tabs and fields. The vast majority of these tabs and fields are now individually customizable so the app can be designed hyper-specific to your institution’s particular needs. This means that third-party users will only see exactly what you need them to see, and you can guarantee a firm hand on law and regulation compliance.

To ensure the security of your customers’ information, your institution uses the Security apps in the Lending Engine to provide third-party users with login credentials (and branch/account restrictions) for the Portal. Once a user logs in, the Portal provides them with read-only access to account information as maintained in CIM GOLD (our loan servicing software). As the account is updated in CIM, it will also be updated in the Portal. What this means for your institution is:

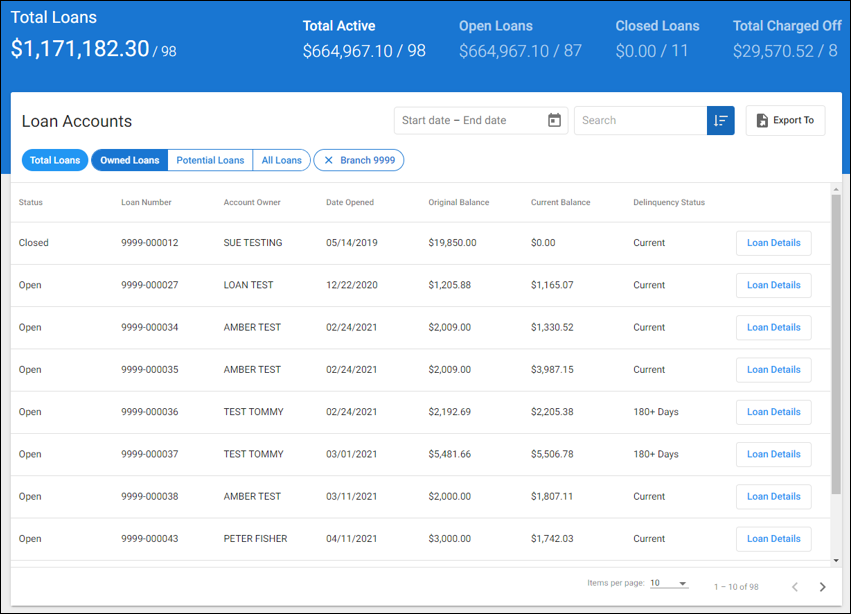

Once they have been granted access, third parties will find the Portal as user friendly as it is useful. The list of accounts on the main screen can be filtered by various criteria and a comprehensive overview of each individual loan is available at the click of a button.

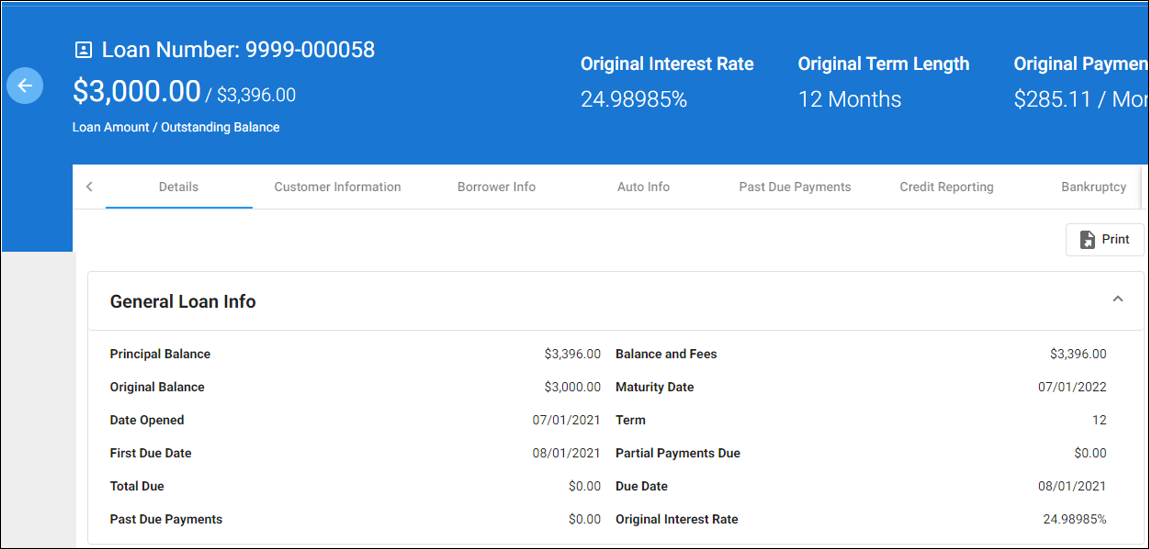

This overview includes:

The GOLDPoint Systems Loan Portal is an essential tool for streamlining your institution’s relationship with investors, vendors, and other third parties. Contact your GOLDPoint Systems account manager for more information about setting up your Portal today.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

It's True.

No two lenders are the same; this is something we have learned after processing billions of dollars in lending transactions and helping lenders...

One of the critical features of our Loan Servicing software is that you can service any of our products, in any state. And while that means a lot of...