Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

2 min read

Charles Burnett

:

October 8, 2021

Charles Burnett

:

October 8, 2021

A couple years ago, GOLDPoint Systems (GPS) introduced our Vaulting service to our clients. This feature, developed to be compliant with Uniform Commercial Code (UCC) regulations, allows institutions to designate watermark settings and restrict access to source documents. When files are attached to customer loan accounts (via File Services Plus), your institution’s vaulting settings will show watermarked versions to most users and allow authorized users to view and edit originals.

This feature is indispensable for getting the most out of your institution’s relationship with its investors. It has undergone a few changes over the last two years, so we thought it would be beneficial to spend some time revisiting and reintroducing it to our readers.

When electronic chattel papers are attached to loan records, government regulations specify who is allowed to view original (source) documents and who must be restricted to viewing copies instead. These regulations state that source documents cannot be altered except by specific personnel who are given security access. This is meant to ensure that control of source documents is only given to authorized personnel and that document copies are watermarked accordingly. Best practices dictate that a secure third party monitor and enforce this authorization. GPS acts as this secure third party on behalf of its client institutions, their customers, and investors.

Because of the sensitive nature of e-signatures and attaching final documents using modern digital methods, it is imperative that documents be secure and trustworthy. Luckily for our clientele, GPS is up to the task.

One of the biggest changes made to our vaulting feature since its original release is that it is no longer accessed from File Services Plus in CIM GOLD (our loan servicing software). As of CIM version 7.21.2, this feature will be exclusively operated by GPS on behalf of your institution. Neither your institution nor its investors can access vaulting security settings or adjust document access. Instead, you will work with your GPS account manager to designate security settings and profile templates.

-Oct-08-2021-04-30-47-33-PM.png) Wow. That honeymoon was over fast.

Wow. That honeymoon was over fast.

Your institution will work with your GPS account manager to create agreed-upon watermark designs that will be visible on loan documents when viewed by individuals who aren’t allowed to view originals. Watermarks appear on documents as a word or phrase diagonally splashed across each page. Your institution can determine what wording, font size, text color, page location, and opacity it wants to use. See an example of a watermarked document below:

-Oct-08-2021-04-32-31-28-PM.png) This is an example of a watermark that says “Copy – Not Original” in a red font.

This is an example of a watermark that says “Copy – Not Original” in a red font.

Investors don’t generally have access to GPS software. Their options for viewing loan account information and documents is primarily restricted to the Investor Portal (a simple web-based application that allows them to view information about the loan accounts they are funding). Investors typically have access to original documents, and the Investor Portal is their primary venue to access them.

Lenders will usually view loan documents in File Services Plus, where they are attached to loan accounts in CIM. Lenders typically do not have access to original documents, so the versions they see will be watermarked.

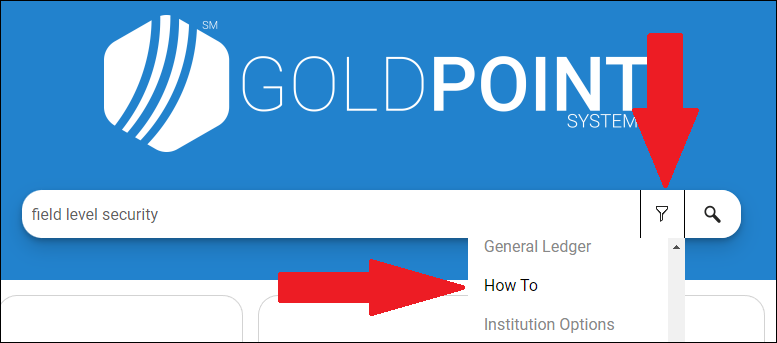

If your institution services investor-backed loans and is not using our vaulting feature, now is the time to make the change. GOLDPoint Systems is committed to the security of your loan documents and their careful distribution to lenders and investors alike. If you are a GOLDPoint client, you can read more complete documentation about vaulting in the Investor Reporting section of the Help Center.

Remember that GOLDPoint Systems prides itself on its commitment to customizing its services to fit your institution’s specific needs. If our products do not currently perform a task you require, contact your account representative to discuss how we can serve you better.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

GOLDPoint Systems prides itself on being the best in the business, and communication is an important part of maintaining that credibility. After all,...

In the complex modern lending industry, supplemented as it is with vendors and investors, institutions that service customer loans regularly need to...

Now that the Help Center is up and running for GOLDPoint Systems and its clients, the documentation team has been able to focus its long-term efforts...