Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

3 min read

Charles Burnett

:

January 12, 2022

Charles Burnett

:

January 12, 2022

At GOLDPoint Systems (GPS), we are constantly improving our products to meet the needs of our clients and an ever-innovating industry. We pride ourselves on the flexibility and customization of our software, and 2021 was yet another fantastic year for changes and enhancements to our system that made life easier for your employees and customers.

Before we start working on 2022, let’s look back and highlight the major innovations introduced over the last year. Remember to reach out to your GPS account manager with questions about implementing any of these enhancements at your institution, and follow the links in the bullet points below to learn more about each new feature.

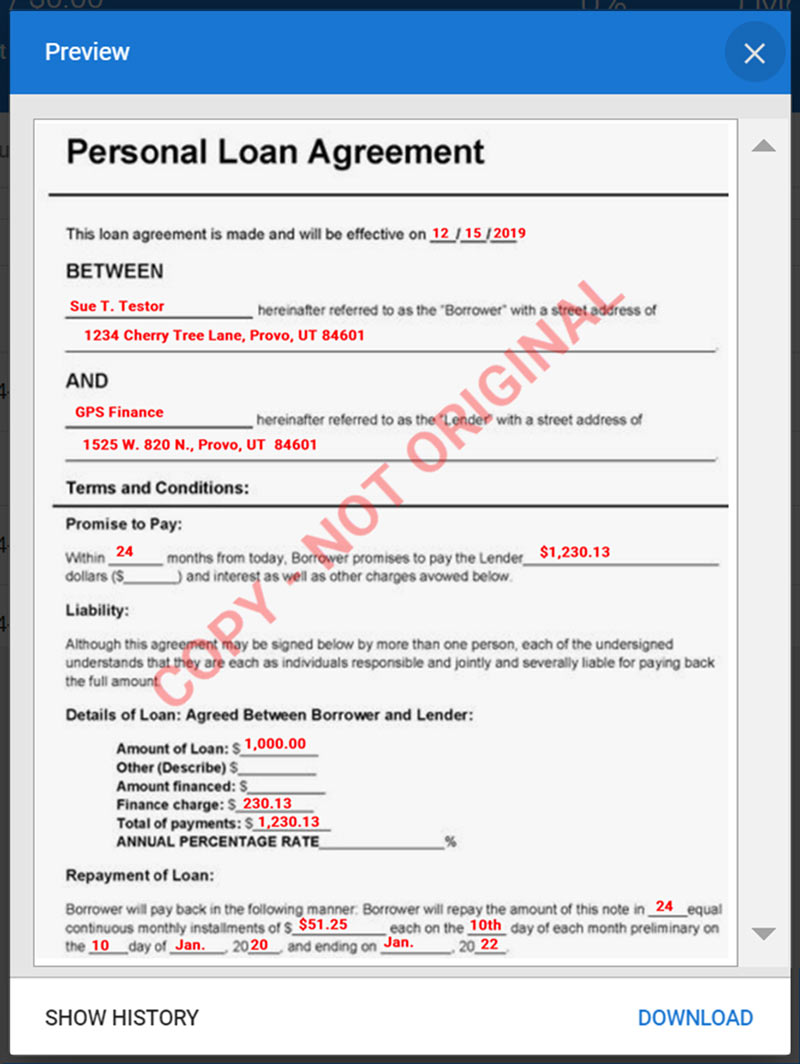

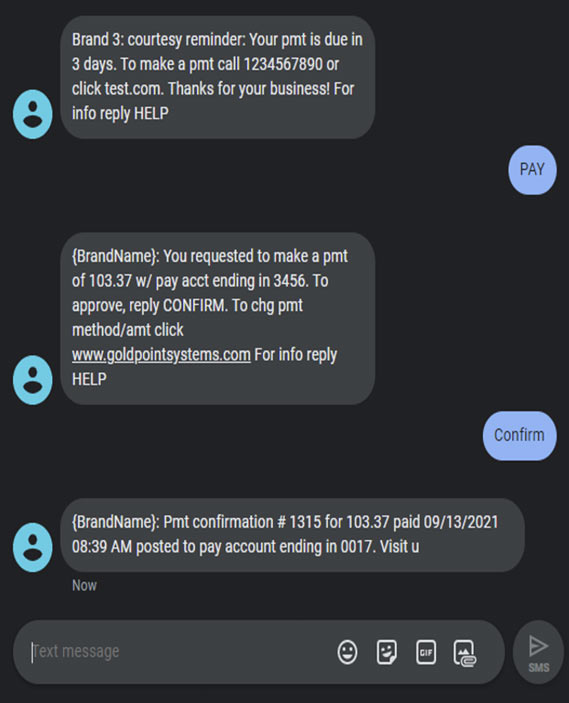

Example of a watermarked document. The watermark indicates that the user is not allowed to view the original copy.

Example of a watermarked document. The watermark indicates that the user is not allowed to view the original copy.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

Not to brag, but GOLDPoint Systems has underwritten 44 million loan applications over the years. That’s a lot, and even dividing up that number among...

In our fast-paced online world the difference between success and failure can be less than a minute. A mind-blowing YouTube video might never be seen...

Earlier this year, we discussed our efforts to make the Help Center even more helpful by infusing it with more task-based, How To-style...