Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

With roughly 26 billion text messages sent every day, a new frontier is opening up. And the brave companies are going to begin taking advantage of it. We want you to be one of those companies and we want to help you do it. With our Pay-by-Text feature, we can help your customers make payments via text. That’s right, payments made in the palms of their hands. It’s pretty cool.

But why would you want to offer the ability to pay via text? Here are just a few reasons:

To sum up, most people text, most people prefer receiving texts over other forms of communications from financial institutions, and most people respond to a financial text during the first 15 minutes. When you look at it that way, receiving payments via text is a no-brainer. Enter Pay-by-Text.

Pay-by-Text is a convenient way to allow your business to accept payments via text messaging. Plus, it improves customer satisfaction by providing a convenient way to pay. It’s a win-win. And, because Pay-by-Text is so easy to use, it can improve on-time payments. In addition, you don’t need any extra employees to implement it because it is completely automatic. Wow, why wouldn’t you use Pay-by-Text?

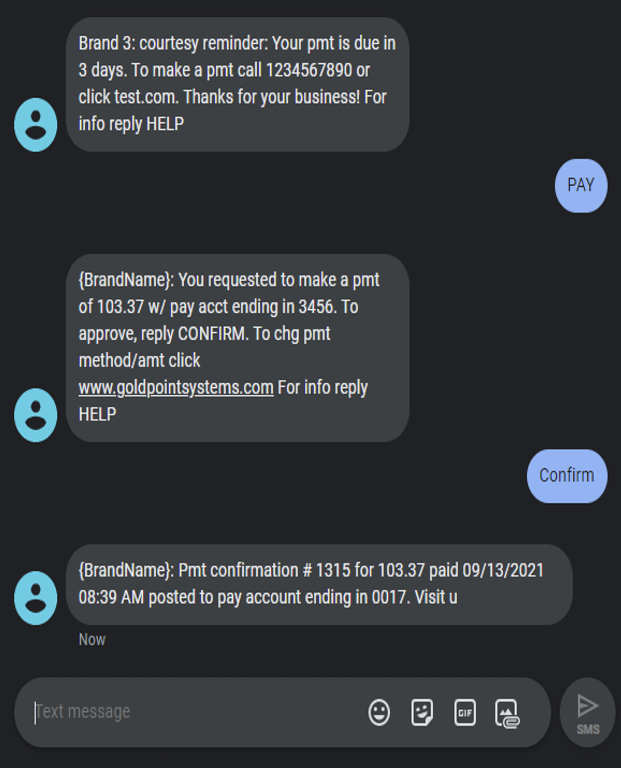

So, let’s dive into the details of how this works. Here is the basic process:

And, voila! It’s as easy as that. For your customers, it will seem even easier. For the system, it’s a little more complicated.

-Dec-13-2021-05-57-33-09-PM.png)

But let’s not talk about that.

There are three options available for Pay-by-Text that can be set up for you by GOLDPoint Systems:

-Dec-13-2021-06-24-54-00-PM.png?width=620&name=image%201%20(3)-Dec-13-2021-06-24-54-00-PM.png)

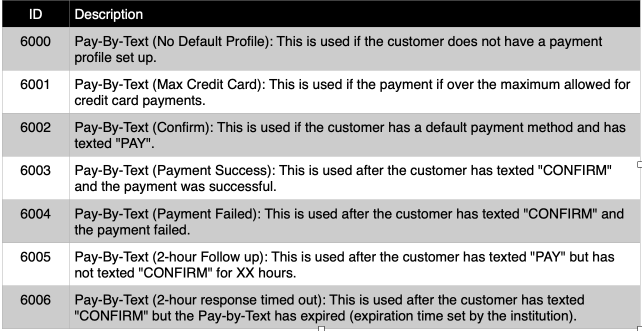

You can set up the templates that you want Pay-by-Text to use with Solutions by Text and then our system uses the templates and maps those to the template IDs we have set up for the Pay-by-Text process. We have the following template IDs set up to use:

There are also a few different ways to set up the default payment account that is used by Pay-by-Text:

-Dec-13-2021-06-29-08-01-PM.png)

-Dec-13-2021-06-29-46-02-PM.png)

In addition, we have the following TORC and Descriptor codes for Pay-by-Text payments:

After a customer makes a payment via text, our system records that payment using the TORC 9 or 10 codes. These codes are shown in the loan history on the Detailed History tab on the Loans > History screen (see below). The EZPay log also shows what payments were made via text (SMS). Plus, the new TORCs can be added to GOLDMiner reports to enable you to track when Pay-by-Text payments are processed, which is pretty sweet if you ask me.

-Dec-13-2021-06-35-10-45-PM.png)

That was a lot of information. Good thing it was all really cool. If you are still on the fence about using Pay-by-Text, consider the fact that over 60% of consumers complete financial transactions using their mobile phones… 60%! Why wouldn’t you want to make making payments easier for the majority of your customers? Besides, most people prefer texting, and that number is growing rapidly. It’s time to jump on board.

Contact GOLDPoint Systems today to get on board with Pay-by-Text!

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

For my kids’ school lunch program, I have a debit card on file in their online payment portal that debits my card $30 every month. I hadn’t looked at...

Good job, America! For the past 8 years, the average credit score for Americans has improved. It’s a great indicator of a good economy.

The Telephone Consumer Protection Act was enacted in 1991 by the Federal Communications Commission. This act was passed long before cell phones had...