Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

Financial companies like yours have been so successful over the past 15 years (we know—we’ve tracked the phenomenal growth of our companies) that probably one of the biggest problems you face is finding even more funding, so you can provide more loans to more people. And securing loans for investors can quite frankly be a hassle.

Investors want to know which loans they are getting; what the return on investment is; how many loans are delinquent in their payments; how many loans are nearing payoff; etc.

It would be exhausting if you had to track it all using spreadsheets and daily reminders. But using GOLDPoint Systems tools, it’s really not so bad. Of all the problems you could have, this one might rank up there with “Gosh, how do I spend all my millions?” (End of cheekiness.)

GOLDPoint Systems has screens, functions, and reports that make establishing asset-backed securities a fairly simple, straight-forward process.

The first thing you need to do after finding investors is to set them up in the Investor system in CIM GOLD. The Investor system is used to tie an investor to various groups of loans. One investor, such as Wells Fargo, may require that loans be grouped by certain guidelines. The Investor system allows you to create an investor master record, which can then be tied to various investor groups. Each group is subsequently tied to the individual loans.

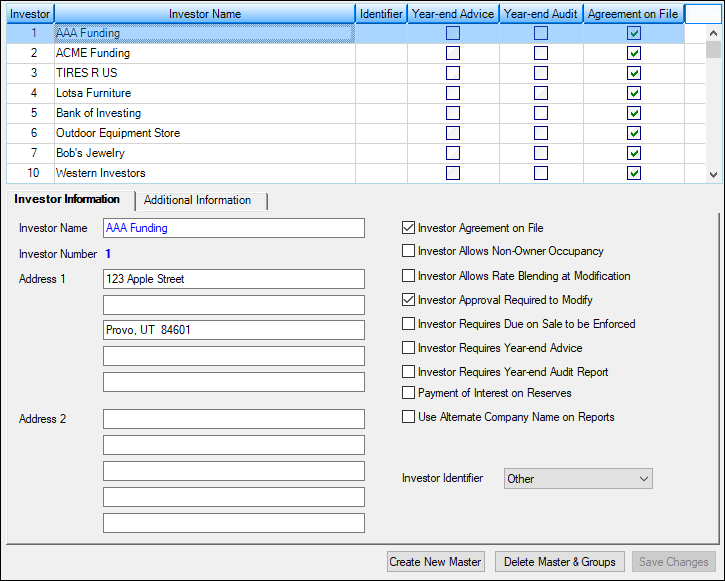

First, a record is created for the investor called the investor master. This record includes the name, address, and other data about the investor. The following is an example of the Investor Master screen:

Loans Investor Reporting Investor Master Screen

Loans Investor Reporting Investor Master Screen

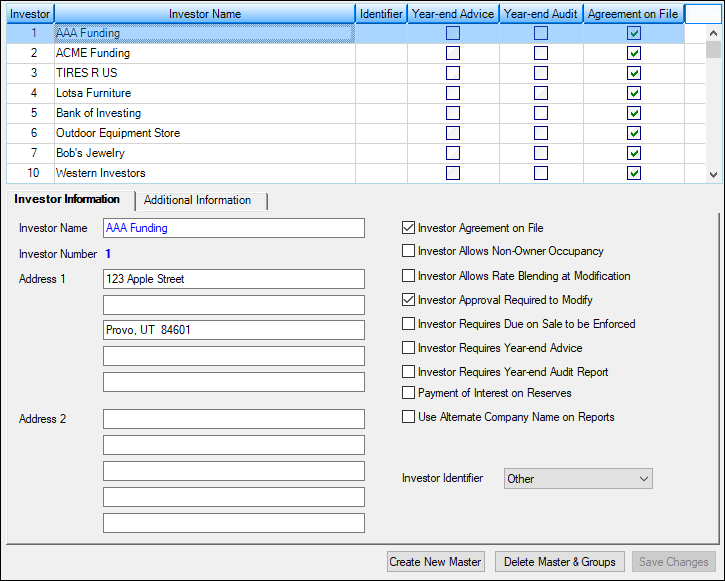

Investor groups are created that are tied to the master record by a master and group number. The investor group contains data such as portion of the loan(s) sold, date of sale, guaranteed interest rate, service fee rate, etc. The following is an example of the Investor Group screen:

Loans Investor Reporting Investor Group Screen

Loans Investor Reporting Investor Group Screen

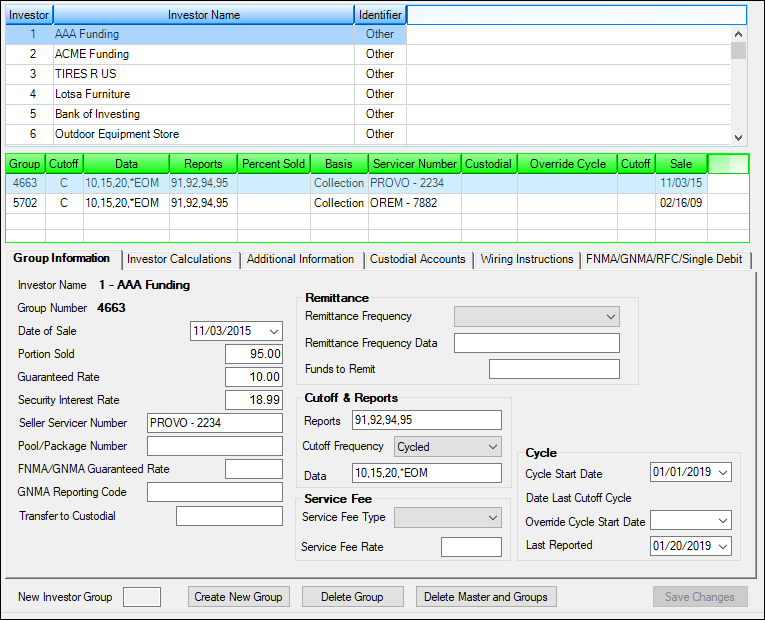

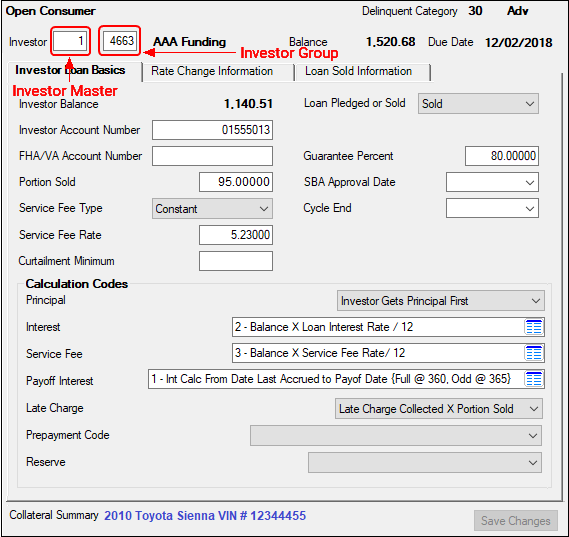

Individual loans are tied to an investor group through the Loan Investor Fields screen by the master and group number, as shown below:

Loans Investor Reporting Loan Investor Fields Screen

Loans Investor Reporting Loan Investor Fields Screen

See the Investor Reporting Screen Group section on DocsOnWeb for detailed information concerning this process.

However, starting in CIM GOLD version 7.9.3, we have created a new screen that can quickly connect established loans with investors for securitization purposes.

A new screen is available, Securitization, under Loans Investor Reporting in CIM GOLD. This new screen allows you to quickly assign loans to an Investor Master and Investor Group. Security for this screen should only be given to supervisors responsible for Investor (Secure) loans.

The following steps explain how to use this screen:

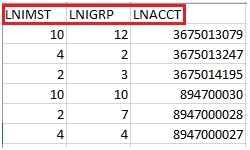

1. Use a spreadsheet program, such as Microsoft® Excel, to enter the loan investor master number, the loan investor group number, and the account numbers assigned to each. This spreadsheet must be organized into three columns with the headers LNIMST (for the Master number), LNIGRP (for the Group number), and LNACCT (for the Account number).Valid Investor Group and Master numbers can be found on the Loans Investor Reporting Investor Group screen. Investor Groups must be tied to a valid Investor Master.Account numbers should include the office number but not the check digit.

2. The file must retain the header names. The order of the columns does not matter, but the three column headers must be spelled correctly, or the file will not upload properly, as shown below:

3. Save the file as a tab-delimited text file and close the spreadsheet program.

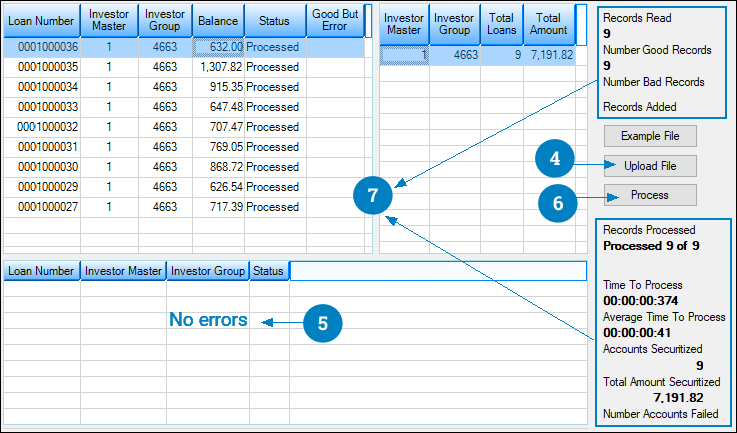

4. Upload the file by clicking the Upload File button on the Securitization screen in CIM GOLD.

5. Any errors with the file upload will be displayed in the bottom list view of this screen. If any errors exist, correct those errors in the spreadsheet, save, then retry uploading.

6.Once the accounts are uploaded with no errors, click the Process button and those accounts will be assigned to the designated Investor Master and Group in CIM GOLD.

7. The fields on the right side of this screen display basic information related to this process, such as the number of records read/processed/added, how many records were good and bad (failed), processing time, number of accounts securitized, and total amount securitized.

See the Securitization screen below outlining these steps:

GOLDPoint Systems has many reports already in place for investors, such as:

But possibly the most exciting thing we have created for investors is a web-based Investor Portal. This portal shows all loans connected to an investor, and your institution can easily send security authorization and a URL address to investors, so they can quickly look at the current status of accounts. Please see next week’s blog post about this amazing new feature.

And for more information about all our investor tools, contact your GOLDPoint Systems account manager. If you are not currently one of our amazing institutions using our product, contact us today for a demonstration.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

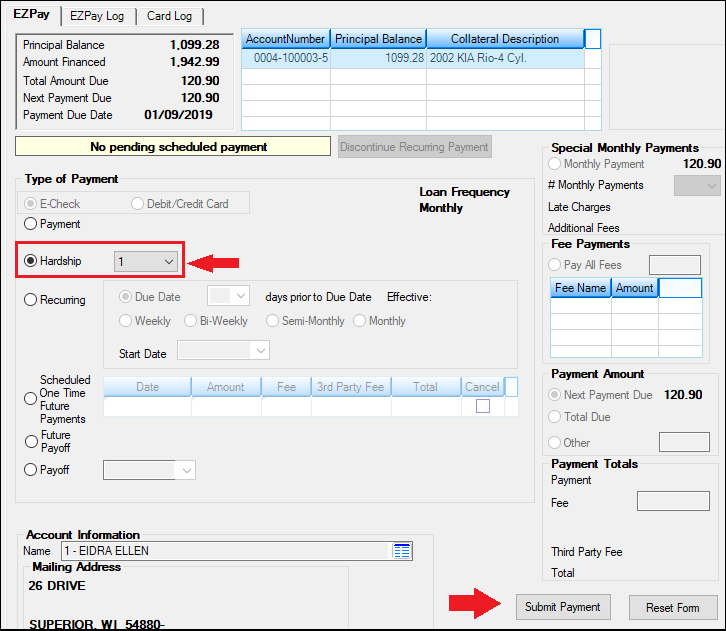

There’s no doubt this Government Shutdown will likely have negative consequences on some of your customers. Missing a few paychecks would be hard on...

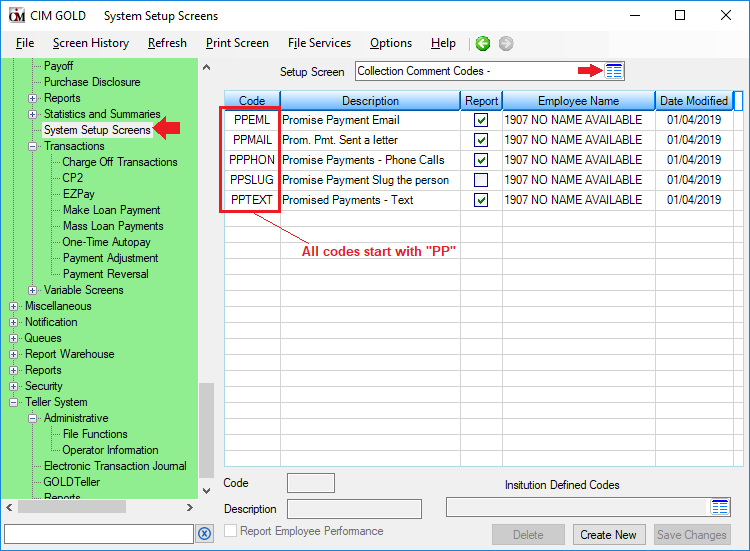

Tracking Collection Efforts Nudging borrowers to make payments is a necessary part of the lending process. Sometimes a soft reminder works best....

GOLDPoint Systems has many possible payment transactions. We have so many, that you may not be aware of payment transactions available for use. In...