Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

3 min read

Cindy Fisher

:

May 23, 2019

Cindy Fisher

:

May 23, 2019

Are you a fan of reading your Venmo feed? The Venmo feed gives you a small peek in how your friends and family spend their money. Venmo’s built-in emojis make money transactions that much more amusing.

Not really sure why it’s so interesting to learn the neighbor down the street got a 💇. It just is.

And we try not to be envious when a family member just paid someone for 🏖️. We can only assume one thing: everyone is having fun and didn’t invite us.

Venmo has also caused a few unintended consequences. Like the woman who didn’t want her parents knowing she was living with her boyfriend, but the parents figured it out from the Venmo feed when her boyfriend paid her:

🏠💸

For some people, Venmo is not for them. Best to just stay away from that drama, as one writer postulates.

Your Venmo feed is customer relationship management meets social media. But unlike Venmo, lending institutions keep customer relationships extremely private and secure.

For lending institutions, customer relationship management establishes the ways people are connected by loan or deposit accounts.

These connections are saved together in “households.”

But how are accounts handled if the household falls apart due to disagreements, divorce, or the company dissolves? Can you “consciously uncouple” the accounts?

Well, it’s not as easy as it sounds. For one, when those loan accounts were signed and contracted, that made both parties on the loan responsible for paying it back. Even if a judge decrees that only one of them are responsible for paying the loan from then on, the lending institution has the right to go after both parties if timely payments aren’t made. (Unless a bankruptcy is also involved with the divorcement, which is common. Then the institution may be forced to not contact either borrower for past due accounts.)

This can be difficult if the breakup is hostile and they disagree on who is responsible for the debt. What it will require is refinancing the loan so only one or the other’s name is on the loan. Getting the parties to agree who will refinance the loan under their name? That’s a whole different blog post that is above my pay grade.

So if you can get the parties to agree on taking ownership of personal debt and refinancing loans under one party’s name, then you can split the household into two households. If the loans stay in both individual’s names, you must maintain the household.

For households where multiple loans exist, and all loans have been refinanced to just one owner, then you can use the Split Household screen in CIM GOLD to split the household and reassign all non-shared accounts to individual owners.

The following steps briefly explain this process.

Splitting the household is a two-part process. The first part is to clean up the information for each borrower. Usually in the case of divorce, one party moves to a different location, so you must enter the new address. Cleaning up the household information first will save you lots of headache during the next part, which is actually splitting up the household. Note: These steps are for supervisors and managers.

.png)

Customer Relationship Management Households Screen in CIM GOLD

Now you are ready to split the household. Complete the following steps:

-2.png)

Now you’ll want to verify that the households split correctly by going to the Households screen for each household number and verifying the split was successful.

See the following example showing these steps:

-1.png)

Customer Relationship Management Household Utilities Split Household Screen

Let’s hope the split is as amicable as that process. And hopefully they can keep the drama off Venmo.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

Summer is a popular time for weddings. The joining of lives, homes, and bills. It’s that last one that can cause marital discord right from day one.

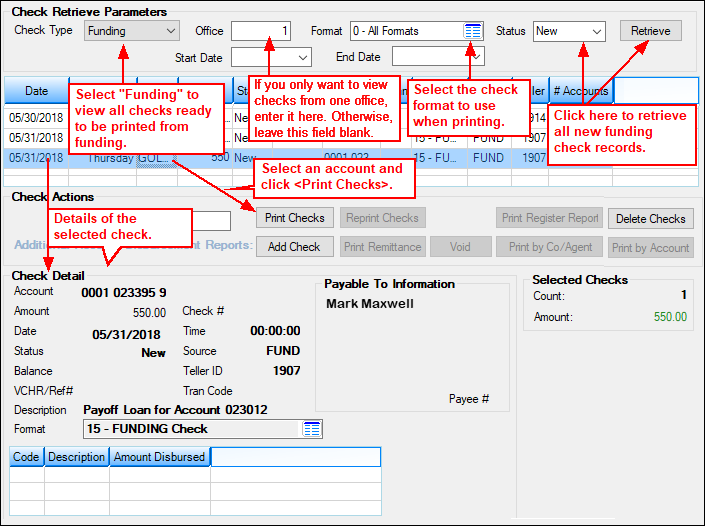

We have created a new Check Printing function in the Loans system in CIM GOLD version 7.9.3. This new Check Printing feature allows institutions to...

We understand that the lending environment is complex and competitive. And to stay ahead of your competition, you need to keep your skills up-to-date...