Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

Good job, America! For the past 8 years, the average credit score for Americans has improved. It’s a great indicator of a good economy.

Even for borrowers with less than great credit, it’s a good time to improve that score by opening new loans and making timely payments.

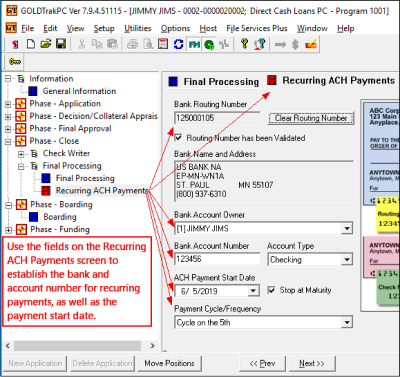

As a lender, you may want to suggest to borrowers to set up recurring payment information as part of the loan application. That way, payments are never late, and the credit score for the borrower will likely improve due to on-time payments.

We can add the Recurring Payment screen to any loan application in GOLDTrak PC, as shown below:

Recurring ACH Payments Screen in GOLDTrak PC

Recurring ACH Payments Screen in GOLDTrak PC

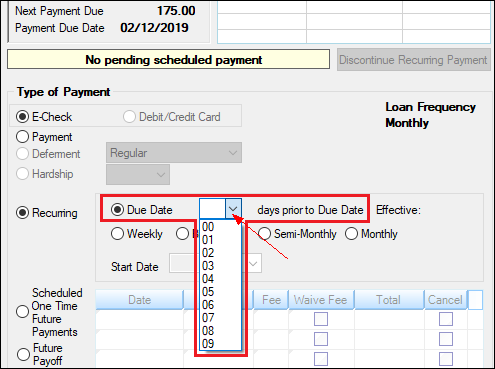

When information is entered on that screen in GTPC for the borrower, the information is transferred into EZPay to use for recurring payments once the loan is opened and boarded into the CIM GOLD loan servicing system (see example below).

.png) Loans Transactions EZPay Screen in CIM GOLD

Loans Transactions EZPay Screen in CIM GOLD

Borrowers can designate when they want the recurring payment to happen each month, such as two days before the Due Date, on the same day as their payday, or another convenient time for them.

Then month after month, the payment is processed using the banking routing number and account number provided by the customer when the loan was opened.

Remember to always check the Exception Report to view any payments that were rejected in the afterhours due to activity on the account (see Best Practice: Examine the Exception Report Everyday).

For more information on how to set up recurring ACH payments, see the following topics in the EZPay User’s Guide on DocsOnWeb:

Understanding EZPay Options: Recurring Payment Use Days Before

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

The EZPay screen in CIM GOLD offers users several options when setting up recurring payments. Perhaps your customers want to pull their recurring...

With roughly 26 billion text messages sent every day, a new frontier is opening up. And the brave companies are going to begin taking advantage of...

Last week we discussed the basics of allowing credit/debit card payments, and how our system can handle any type of card payment transaction your...