Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

I’ll wager a safe bet that you haven’t thought about the Over/Under Report lately, have you? Well, with the new recurring payment options available in CIM GOLD version 7.9.3, it’s time we explain why this report is important.

For starters, now that our institutions’ customers can set up more frequent recurring payments, the odds of having the final payment being more than the required amount for payoff are higher.

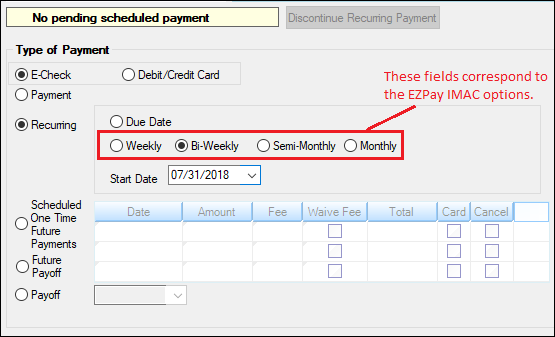

When users set up payments on the EZPay screen for more frequent payments than their regular loan frequency (e.g., weekly recurring payments for a loan with a frequency of monthly), they must select an amount to enter in the Other field. When the Other amount is used, the system is hard coded to send that amount via ACH or card for loan payments each frequency.

Even if the final payment is less than the Other amount, the system still sends that Other amount. Therefore, the final payment will likely be an overpayment (or possibly an underpayment that still pays off the loan because the underpayment is within the limit set up in institution option MAUP).

What does the system do with the amount of overpayment?

First, any accounts that were paid off in the after-hours with an overpayment remaining are included on the Over/Under Report (FPSRP297). The overpayment must be more than the amount entered in institution option OVCK (Minimum Check Amount for Overpayment), or the account will not be included in the report.

The system also creates a check invoice record for that account in the Accounts Payable system, where a check can be printed to the borrower for the over amount. The system only creates invoices for overpayment checks if client #1 is set up in Accounts Payable and a vendor for each loan type is entered in the Accounts Payable system. The loan account number is the invoice number. If those things are set up, then users with proper security can print the overpayment check for invoices from CIM GOLD (using the Financial Applications > Accounts Payable > Check Printing screen) or through Accounts Payable, function 20, Check Printing, in GOLDVision.

If the institution does not want to handle overpayments that way, they’ll need to carefully monitor the Over/Under Report each day to see which accounts paid off with an overpayment. Then they can manually create a check in CIM GOLDTeller to the borrower for the amount of the overpayment.

Many institutions wait one or two weeks before processing that final overpayment check in case the final payment is rejected or returned for any reason.

The best way to describe this process is with an example.

Let’s say I have a $300 loan with monthly payments of $25. My loan has a frequency of monthly, but I would like to pay $10/week using a recurring payment from my checking account.

The user would set up EZPay according to these specifications. Each week a payment will be processed against my account for the amount of $10. Let’s say I now only have $5 left on my loan. On the next recurring payment date, the system would still process $10 to my checking account, but I only owe $5 more. Institution option OVCK is set to $2. So, I would be eligible for a $5 overpayment check.

In the after-hours of the final payment, my account would show on the Over/Under Report, including the amount of overpayment.

The institution would then issue me an overpayment check of $5 according to their rules/regulations (e.g., wait for two weeks, write the check in CIM GOLDTeller, etc.).

For more information on this process, see the Over/Under Report (FPSRP297) documentation in DocsOnWeb.

Also, see the Recurring Payments topic in EZPay for more information concerning the new Multiple ACH Payments in the Same Loan Frequency.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

Your institution may have many good business reasons for not allowing borrowers to make payments using debit cards. For one, allowing debit card...

Setting up automatic ACH recurring payments is an excellent way for both borrowers and institutions to ensure payments are made on a timely basis....

At the end of 2018, a record 7 million Americans were 90 days or more behind on their auto loan payments. What does this mean for lenders? It means...