While Black Friday shopping in November of 2020, I stopped into a well-known women undergarment store that shall remain nameless. The helpful teller asked if I wanted to open a credit card that day and receive 30% off my buy-one-get-one-free items. I was already feeling so great about my discounted items, that an additional 30% off sounded even more magical. So I opened up a card with the intent to pay it off as soon as I received the bill in the mail later that holiday season.

Around the last part of December, I received my bill in the mail. I dread making online payments because I’m required to create a username and a password, and should I not pay it all off that month, it’s up to me to remember the password for next month’s payment. I knew I wouldn’t be having a balance on this account for long, so remembering this one-time password seemed like a waste of my precious brain space. (Or in my case, not remembering, so then I do the “forgot password” dance.)

But this department store statement printed a little QR code that I could scan with my phone to make a direct payment without needing a username or password.

I just scanned the QR code using my iPhone; the details of my account showed in my Internet browser; I finished filling in my debit card information; and I clicked the pay button. I could release that one bill from my mind—sort-of like Uncle Billy in It’s a Wonderful Life removing a string from his finger (to keep with the whole holiday theme of this blog post).

One-time Payments

If your lending institution is in the habit of lending small-dollar loans, offering a one-time payment option in the loan servicing software may be appealing to your borrowers. That way they enter some code or number you print on the billing statement, and they don’t have the trouble of remembering a password to log onto your payment website. All that is required is a few fields, a couple of clicks, and they can make their payment. The code enables the system to bring up the person’s account balance, and it doesn’t save the card information for future use.

Around here we refer to these one-time payment processes as “the Grandma Bit.” We refer to it as that because the intention is that if a grandma, mother, father, rich uncle is willing to pay the bill, they would be able to make the payment without having to save their card or banking account information. (Where can we find a rich uncle when we need one?)

But it can also just be for the account owner making the payment as well. Some people aren’t comfortable saving their card or banking information for future use.

More and more of our institutions are creating their own payment websites but using our APIs to connect to our loan data. We offer many payment APIs, one of which can be used as a one-time immediate or future payment. But only one time. The system will not remember the card information.

Browsers Can Remember Card Information

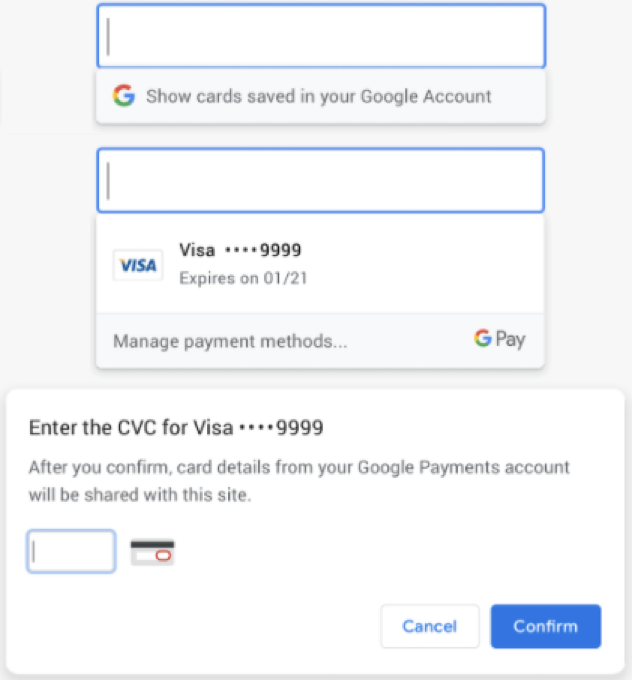

One thing to look out for is that Internet browsers, such as Chrome, can remember card information if the “save payment card profile” feature is enabled on the

That’s why many payment websites will have a disclaimer warning the payer to not enable card saving if paying from a computer that is not their own (e.g., library or school computer used by the public).

If you do offer a one-time payment option, it may also be helpful to warn account owners about not saving card profile information on public-use computers.

If you are a fan of Kim Komando, you already know how the radio host dishes out technology advice for her listeners. Her website has a great blog post on how to remove saved credit card information from your browser.