Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

4 min read

Cindy Fisher

:

November 29, 2023

Cindy Fisher

:

November 29, 2023

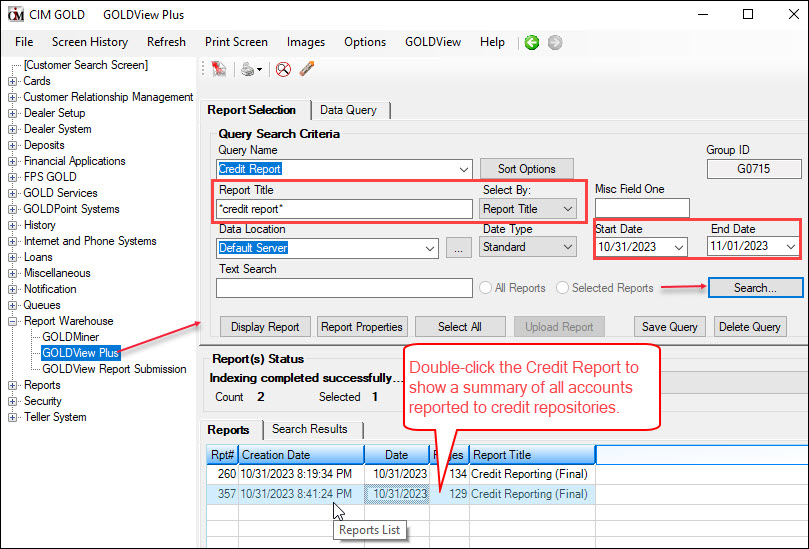

Each monthend, our system runs credit reporting for every institution who reports accounts to the credit repositories (Equifax, TransUnion, Experian, etc.). As part of the credit reporting process, our system generates a summary report that shows in GOLDView Plus within CIM GOLDâ, as well as a csv-formatted Excelâ file that shows the details of how each account was reported.

Most of our institutions are very familiar with how to open the .csv file from GoAnywhere, our secure data sharing location on the Internet where we transfer files to and from our system on behalf of institutions and the third parties with whom they do business. Many institutions will run that .csv file through third-party software for additional safekeeping efforts, as well as data analysis to determine if the credit reporting we are generating is correct.

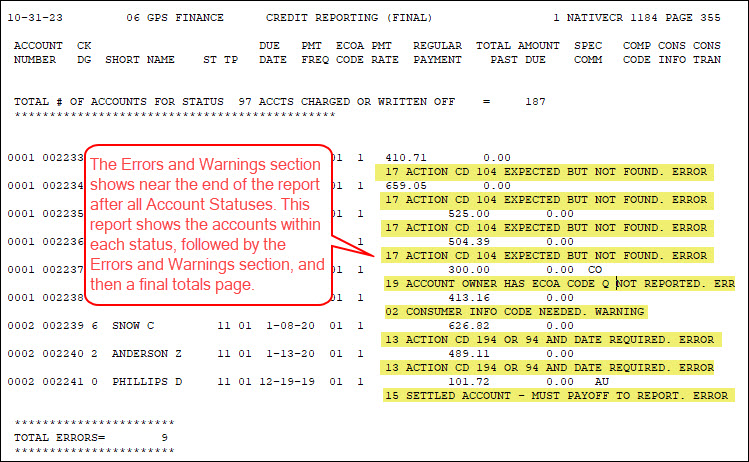

One very important tool we provide our institutions is an Errors and Warnings section of the Credit Report found within GOLDView Plus. We suggest that every institution look at that section of this report the first day of the month to see if any accounts show up in that Error section.

See examples below of how to find this report in CIM GOLD, open it, and view the Errors and Warnings section:

GOLDView Plus within CIM GOLD

Credit Report Errors and Warnings Section

When errors show up on this report, you have five days (for most our institutions) to contact your GOLDPoint Systems account manager to help you with changing field data and re-running the credit reporting process to clear those errors and report accounts appropriately. If you do not monitor this report and errors section, accounts that should have reported might not be reported. And if you wait longer than five days to contact your GOLDPoint Systems account manager, you may need to wait until next month to adjust these accounts. After five days, we automatically send your credit report file to the credit repositories. Credit repositories do not like getting two credit reporting files in the same month, so you will need to wait for next month if the adjustments weren’t made before the fifth day of the month.

The following paragraphs explain the most common errors and how to adjust accounts, so the accounts are no longer included in the Errors and Warnings section:

This warning shows if the account has a Hold Code 4 (Bankruptcy Chapter 7 or 11) or 5 (Bankruptcy Chapter 13), yet there is no Consumer Information Indicator (CIID) set up on the borrower. This can happen if someone accidently file maintained the Hold Code to be 4 or 5 yet didn’t bother to update the CIID code; or someone accidently adjusted the CIID code on the Households screen for borrowers to remove the appropriate CIID code yet didn’t adjust the Hode Code 4 or 5.

To be on the safe side, Hold Codes 4 and 5 should only be added/removed when running bankruptcy transactions from the Bankruptcy Detail screen in CIM GOLD. They happen automatically when bankruptcy transactions or follow-up actions are run. Users should not be file maintaining accounts manually by adding Hold Codes or CIID codes.

Accounts and borrowers will still show on the credit report transmission if this warning message appears on the report; however, they might be missing a CIID code. So, you should resolve this for the next monthend credit reporting.

This is likely the most common error. When accounts are 30+ days delinquent from the Due Date at the end of the month, the system will assign the account with Action Code 194 at monthend and a date the account reached 30 days late from the Due Date and use that date as the Action Code 194 Date. Our system only has 10 action codes and sometimes other action codes can fill up the available slots before monthend runs. If all the available action code slots are filled up, the system cannot add Action Code 194, and therefore, the account will show on this report with that error. We do not want our system making the decision as to which action code to replace. Therefore, this is a decision that must be made by institution personnel who should manually insert Action Code 194 and the date. The date on Action Code 194 becomes the Date of 1st Delinquency on the credit report transmission.

One caveat is an Action Code 94 and date. Action Code 94 correlates with the date a bankruptcy transaction is run on an account. The system will use the Action Code 194 date as the Date of 1st Delinquency if there is both an Action Code 94 and Action Code 194. When accounts become current, the Action Code 194 date is removed at monthend. However, if the account is still in bankruptcy, the Action Code 94 and date are never removed; therefore, the Date of 1stDelinquency will be the Action Code 94 date. This is how our software complies to the CDIA’s alternative bankruptcy reporting, as will be discussed in a future blog post.

So, this message could also appear if there is a Hold Code 4 or 5, is current, and someone removed Action Code 94from the account.

You should correct this by making sure there is a blank slot in the Action Codes or if bankrupt, that there is an Action Code 94. You may need to re-run credit reporting after making these changes on the monthend set (and live set) if wanting to correct the current month. Or adjust the accounts only on the live set and wait for next month’s monthend to adjust the accounts accordingly.

This error message shows when an account is sold or released to another institution and Action Code 104 and the date the account was sold/released was not included when the loan was released. Our system needs that action code to determine when to start and stop reporting sold/released accounts. See the Sold and Service Released Loans topic for more information.

For more information on our credit reporting process, see these helpful links in the Help Center:

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

GOLDPoint Systems automatically sends a transmission to the credit repositories each monthend detailing account activity. We can send transmissions...

In the complex modern lending industry, supplemented as it is with vendors and investors, institutions that service customer loans regularly need to...

Staring down mountains of data, is your heart rate ticking upward and upward? Are your hands trembling as you reach for your mouse to make sense of...