Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

5 min read

Katrina M. Wilkins

:

July 19, 2023

Katrina M. Wilkins

:

July 19, 2023

We need to talk. And it’s going to be awkward. Like that hygiene conversation with your tween, where you have to tell them it’s time to start wearing deodorant.

I know, I know … you don’t want to hear it.

But, you need to check the Afterhours Processing Exceptions Report. Every. Single. Day.

Let’s talk about why.

OK, let’s start at the beginning. If you don’t know what I’m even talking about, let me explain what the Afterhours Processing Exceptions Report is.

Every night, during afterhours, your GOLDPoint Systems software processes certain kinds of transactions. This includes recurring card and ACH payments, among other things. But sometimes, there’s a problem with a transaction and it doesn’t get completed. (Hold codes, anyone?)

Imagine the havoc that could cause, when you and your customers all think that a payment

has been processed, but in fact it hasn’t been.

To quote the estimable Dr. Peter Venkman: “Human sacrifice! Dogs and cats living together! MASS HYSTERIA!”

Don’t worry, though—we’ve got you covered.

Because every time one of those transactions doesn’t get processed correctly, your GPS software logs it and puts it into a nifty little report that you can see the next morning. We call it the “Afterhours Processing Exceptions Report.” (See what we did, there?) Or, to give it its more formal title, “FPSRP013.”

Let’s say your customer has a P/I Constant of $120 on their loan. The principal balance remaining on the account is $80, plus $20 of interest. Additionally, the account has an outstanding late charge of $25. The Payment Application settings on this account tell the system to take interest first, then principal, then late charges. Of the $120 recurring payment, $100 would go to principal and interest, and another $20 would go to late charges, but $5 would still be owing. The system now doesn’t know what to do with the outstanding $5—since it’s only late fees, and a loan that doesn’t have principal or interest isn’t a loan, so the system can’t keep it open. So, being unsure what to do, the system rejects the payment and makes a note in the Afterhours Exceptions Report.

You and your employees are busy—you’ve got butts to kick and names to take, not to mention fires to put out and a few dragons to slay. So you don’t look at the report in the morning. You’ll do it tomorrow. And then, what with one thing and another … well, now it’s next Tuesday and no one has looked at the report for over a week.

That customer whose recurring ACH payment was rejected? She’s now been assessed a late fee of $30. Plus, the loan accrues interest daily, so in the intervening days (before the late fee was assessed), the account has accrued more interest. The borrower assumes her account is paid off; however, the system still thinks it’s active and has recurring payments. So the next day during afterhours, when the system sees that the account is not paid off and recurring payments are still on, it will attempt to make another payment. And the cycle will continue. (Also, once that customer realizes that her account isn’t paid off and that she’s been assessed a late fee, she’s gonna be pretty upset—after all, it’s not her fault that the account didn’t get paid off in time.)

And that, my friend, is why you really do need to check the Afterhours Processing Exceptions Report—every single day. Trust me: It’s a small daily habit that can save you tons of time, money, and hassle in the long run.

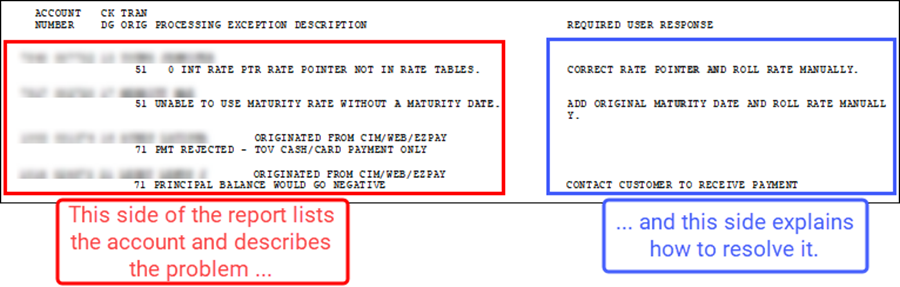

Here’s the best part: Not only does the Afterhours Processing Exceptions Report (formally known as FPSRP013, you’ll recall) tell you which transactions weren’t processed, but it also tells you what you need to do to fix the problem. Here’s an example:

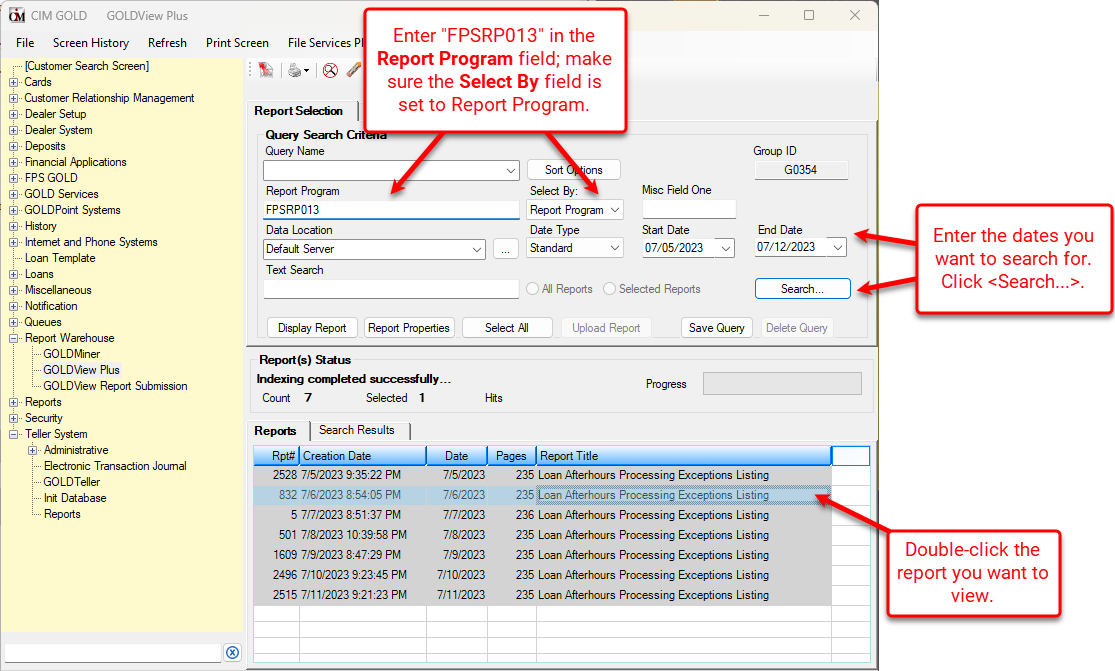

And, in case you’re wondering, it’s really easy to access this report. Here’s what you do:

Here’s an example:

So how, you ask, would a transaction wind up on the Afterhours Processing Exceptions Report? And, more importantly, how the heck do you take care of them?

Well, there are lots of reasons this can happen. Here are some of the most common ones.

Here are a couple of conditions that would cause an account to show up on the Afterhours Exception Report, and what you can do about them.

Look, I know this isn’t the most exciting topic.

But, I hope our little talk today has helped you see how important—and useful—the Afterhours Processing Exceptions Report is. (Pop quiz: What is its formal name? That’s right, FPSRP013. Well done!)

Now, go look at this report every day (or assign one of your employees to). Make it a habit. Read this short blog by James Clear (author of Atomic Habits) if you need some inspiration: How to Build a New Habit: This Is Your Strategy Guide.

Watch how much more smoothly your institution runs—not to mention all the time, effort, and money you start saving—when you know what really happened during your afterhours.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

At the end of 2018, a record 7 million Americans were 90 days or more behind on their auto loan payments. What does this mean for lenders? It means...

GOLDPoint Systems is pleased to announce that we are in the final preparation stages of our new 7-day-a-week processing. Seven-days a week, 365 days...

December. The year is winding to a close and your institution’s employees are becoming increasingly scarce in the wake of holidays and vacations....