Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

December. The year is winding to a close and your institution’s employees are becoming increasingly scarce in the wake of holidays and vacations. However, there is still plenty of work to do, and now is a perfect time to make sure all your ducks are in a row before the rush of paperwork and deadlines.

Credit repositories are, of course, organizations that really like their ducks organized. And keeping credit repositories happy makes life easier for you and your customers. Therefore, when the time comes to sell loans to another servicer, you want to make sure that the accounts being sold are reported correctly. Today, we’d like to take a few minutes to show you how.

CDIA guidelines explain how to report sold loans. In their Credit Reporting Resource Guide, Frequently Asked Question number 47 describes how accounts that have been sold to another company should be reported. Our system is programmed to follow these guidelines, and there is a minimal amount of preparation that is required by your institution.

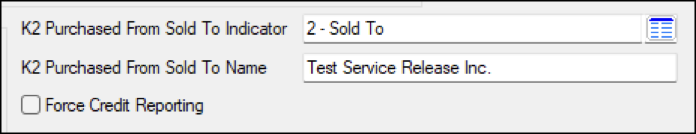

Generally speaking, when loans are sold to another institution to service, they are sold as bundles. In this case, your institution will submit a work order to GOLDPoint Systems to the relevant fields on the loan accounts. However, if your institution is only releasing a handful of loans at a time, employees can manually update these fields instead as directed below (this information is also helpful to know what to look for if you need to verify that certain accounts are being processed properly).

Once the system detects Action Code 106 on an account, it processes the service release at the first month end following the Action Code date (which will become the account’s closure date). A Special Comment code will be placed on the account (code AH, to signify “purchased by another company”) and the account’s current balance, scheduled payment amounts, and any amount past due will be zeroed out. The company name that was indicated in the K2 fields will be reported in the Credit Report transmission.

One other important field the credit repositories need, if applicable, is the Date of First Delinquency.

“If the account is delinquent or derogatory at the time of sale, report the date of the first 30-day delinquency that led to the status being reported. If the account being sold is current and included in bankruptcy, report the date of the bankruptcy petition or notification…Additionally, if the account is delinquent or derogatory, it is imperative that you provide the date of the first delinquency that led to the account being sold to the debt purchaser.”

When necessary, GOLDPoint Systems includes the proper Date of First Delinquency according to these guidelines.

The sold account will be included in your institution’s credit reporting for the Action Date month and the following two months but will stop appearing in the report after that. Congratulations! With these steps accomplished, you’ve crossed all your Ts, dotted your Is, and you can let that loan go without any further worries.

GOLDPoint Systems prides itself on its commitment to customizing its services to fit your institution’s needs. This includes fulfilling work orders to mass-process service releases as well as providing options for increasing/decreasing the length of time sold loans are included in credit reports. If our products do not currently perform a task you require, contact your account representative to discuss how we can serve you better.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

At the end of 2018, a record 7 million Americans were 90 days or more behind on their auto loan payments. What does this mean for lenders? It means...

Four years ago, we published a small series of blog posts discussing tips and tricks for navigating DocsOnWeb, our old help documentation website....

Credit reporting is becoming more important in everyday life for consumers. Their credit history not only unlocks opportunities for credit, but is...