Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

4 min read

Cindy Fisher

:

May 28, 2020

Cindy Fisher

:

May 28, 2020

GOLDPoint Systems categorizes loans once they’ve been opened into seven different payment methods. The payment method determines how to calculate interest and what rules to follow in processing the loan account. Line-of-credit loans are one type of payment method.

Additionally, line-of-credit loans can function slightly differently based on the following three types:

This blog post will explain how Average Daily Balance is calculated in revolving line-of credit.

Nearly everything in line-of-credit loans keys off the Billing Date. The Billing Date is when the system calculates the finance charges (accrued interest) and billing amount for the loan for that month. The Fi-nance Charge Code field tells the system when to run the billing cycle, or when to calculate the amount of finance charges for that month.

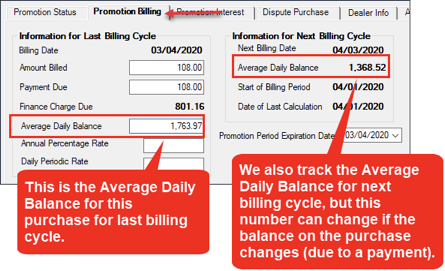

A big part in calculating the finance charge amount each billing cycle is the Average Daily Balance. Inter-est on a line-of-credit loan is calculated monthly through the average daily balance method. This method requires knowing the Average Daily Balance. Luckily for you, GOLDPoint Systems software calculates it for you and shows you the Average Daily Balance for each purchase and displays it on the Promotion Billing tab. See below:

But if you are one of those nerds (aren't we all?) who wants to calculate it yourself, here's what you do:

First you need to know the balance of each purchase (promotion) for every day of the billing cycle. Then you add up each day's balance and divide that number by the number of days in the billing cycle.

Example:

February 26 - March 10 the balance was $500

$50 payment made on March 10, bringing the balance to $450 until March 25, which is the Billing Date.

Feb 26 - March 10 is 13 days. 13 X $500 = $6,500

March 11 - March 25 is 14 days. 14 X $450 = $6,300

$6,500 + $6,300 = 12,800 / 28 (days in the billing cycle) = $457.14 This is your Average Daily Balance for that billing cycle.

You would repeat this process for each purchase/promotion on the loan, if the loan has more than one promotional balance.

But you aren't done yet. We need that Average Daily Balance to calculate the finance charges (accrued interest) for the billing cycle. See the Average Daily Balance Finance Charge Calculation below.

Now that you know the Average Daily Balance, you can calculate the finance charge for the billing cycle. Again, we show all this for you on the Promotion Billing tab, but if you want to test it out for yourself, here's how we do it.

We take the current interest rate of the purchase/promotion and divide it by 12 (for periodic interest. LOC card loans do not do daily interest, which is a slightly different calculation). Then we times the Average Daily Balance by that percentage amount.

For example, let's say the current interest rate is 18.888 percent.

.18888 divided by 12 = 0.01574.

$1,266.67 times by .01574 = $19.94, which would be the finance charges that billing cycle.

Seems easy, right? Not so fast. What if the loan was accruing interest at one rate during part of the billing cycle, but then the interest rate went up for the last 15 days of the billing cycle?

The system can handle that, no problem. Here's an example:

Loan Balance on April 1 is $5,000 with a promotional interest rate of 2.99 percent. On April 18 the promotional interest is dropped and the standard interest rate of 19.99 is now in effect from April 18 on.

First, we figure out the Average Daily Balance from April 1 to April 18. If you want to know exactly how Average Daily Balance is calculated, see Average Daily Balance Calculation above. But let's just cut to the chase and tell you it's $5,000.

5,000 X .0299 / 12 = $12.46 This is the finance charges for the low-interest rate of 2.99 for the billing cycle.

Now we calculate Average Daily Balance from April 18 to April 28 (the Billing Date), which is $5,000.

5,000 X .1999 / 12 = $82.29

Finally, add the two amounts together, and that's the finance charge for this promotion.

Perhaps some more examples would help illustrate this the best.

Example 1:

Jill started the billing cycle with a $1,000 balance. This would be her daily balance until she makes another purchase or payment. If she makes another $200 purchase on day 5, the daily balance would increase to $1,200. Then she makes another purchase on day 15 of $600. Her balance activity looks like this for the month:

Day 1: $1,000 (balance)

Day 5: $200 (purchase)

Day 15: $600 (purchase)

Let's say there are 30 days in this billing cycle. By adding the balance of Day 1, Day 2, Day 3, and so on, the total would be $38,000 for the entire 30-day billing cycle. (Five days at $1,000; 10 days at $1,200; 15 days at $1,400). The system divides $38,000 by 30 to get an Average Daily Balance of $1,266.67. This is the amount that your institution uses to determine the interest charges (finance charge) each month.

Let's say the current interest rate is 18.888 percent.

.18888 divided by 12 = 0.01574.

$1,266.67 times by .01574 = $19.94, which would be the finance charges that billing cycle.

If the loan is in a promotional period where the interest rate is only 3.99, then:

.0399 divided by 12 = .003325

$1,280 times by .003325 = $4.21 in finance charges that month.

Example 2:

Jill started the billing cycle with a $1,000 balance. This would be her daily balance until she makes another purchase or payment. She makes a $200 payment on day 13 of the billing cycle.

From Day 1 to Day 12, her daily balance is $1,000.

From Day 13 to Day 30, her daily balance is $800.

12 X 1,000 = $12,000

18 X 800 = $14,400

14,400 + 12,000 = $26,600 (sum of daily balance in billing cycle)

$26,600 divided by 30 = $886.67 Average Daily Balance

Interest Rate = 18.888

.1888 divided by 12 = 0.01574

$886.67 X .01574 = $13.96

If the loan is in a promotional period, where the interest rate is only 3.99, then:

.0399 divided by 12 = .003325

$886.67 X .003325 = $2.95 in finance charges that month.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

In the complex modern lending industry, supplemented as it is with vendors and investors, institutions that service customer loans regularly need to...

One of the critical features of our Loan Servicing software is that you can service any of our products, in any state. And while that means a lot of...