Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

3 min read

Cindy Fisher

:

April 26, 2022

Cindy Fisher

:

April 26, 2022

When a person files for bankruptcy, our system is designed to stop all current and future ACH payments that may be set up on the account. This is both in our legacy Bankruptcy system and our current Bankruptcy system.

ACH payments are payments made with a bank’s routing number and person’s savings or checking account number. They can be set up to be paid immediately, where we batch up all immediate ACH payments and send them to a bank or Federal Reserve later that day. They can also be set up to be paid in the future. Or they can be set up to be paid on an automatic, recurring basis.

It's important to stop all ACH payments once a bankruptcy has been applied to a person. For one, accounts of persons who have filed for bankruptcy must be handled carefully. It’s not uncommon for bankruptcy courts to restrict payments from being made unless through an attorney or trustee. So, if an automatic, recurring payment is set up on an account, and the person files for bankruptcy, it’s best for our system to just stop the future or recurring payments. If it’s later determined that automatic, recurring payments can resume as before, the recurring payment can be added again.

Timing of payments and bankruptcies can be an issue. This doesn’t happen often, but we’ve seen the following issue twice now in the last month from two different institutions, so we thought a blog post and teaching moment might be helpful on how to handle payments and the timing of bankruptcies.

ACH payments can be taken from your front-end tellers using the EZPay screen in our loan servicing software called CIM GOLD. Or they can be set up by your customers using your institution’s payment website or the payment website we’ve developed called GOLD Account Center (GAC).

The way ACH works is that the funds are routed to a recognized ACH bank or directly to the Federal Reserve Bank if your institution is an ACH-authorized router. We combine all the ACH payments and send them to the bank or FRB at a designated time each evening. Some institutions batch ACH payments and post them early in the morning of the recurring or future payment.

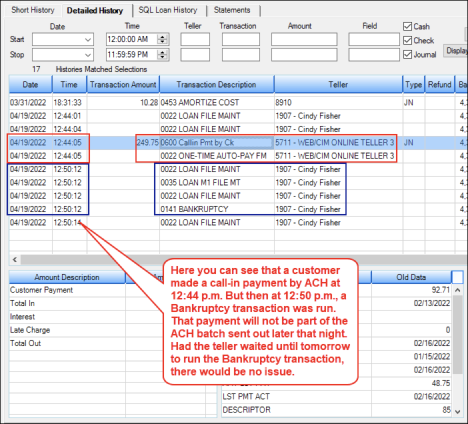

ACH payments post to the account immediately, but if later someone runs the Bankruptcy transaction on the person, any ACH payments tied to that account will be flagged to “stop”. The ACH payment will not be included in that evening’s batch to the bank or FRB.

We have tools to show if an ACH failed for various reasons, such as a loan reaching maturity and your institution doesn’t allow payments past maturity. But in the case of this scenario, the account would not show on any reject reports or web activity logs. That’s why this is such an important teaching moment.

For example, say a borrower makes an online ACH payment at 8:30 a.m. from your website. At 3 p.m. that day, you get a letter that this person filed for bankruptcy, so a user goes into CIM GOLD and runs a Bankruptcy transaction on the account.

That ACH payment that was made earlier that morning will be flagged by the system to “stop” once the Bankruptcy transaction is run. In other words, the ACH payment will not be included in the batch to the bank or FRB.

Had those two actions been reversed—the Bankruptcy transaction is run first and later in the day the ACH payment is made through GAC—then there wouldn’t have been a “stop” and the payment would have been included in the ACH batch to the bank or FRB.

Additionally, had the payment been made the day before, and the next date the Bankruptcy transaction was run, that also would not have been an issue, because the payment would have been included in that previous night’s batch of ACH payments to be sent to the bank or FRB.

There really isn’t a good way to create programming to accommodate for such situations. This doesn’t happen often, and we have no way of knowing intent. In other words, a future ACH payment looks and acts identically to an immediate ACH payment. Our software has no way to determine how to stop the immediate future ACH posting but not the immediate ACH posting.

Therefore, the best solution is to train those individuals at your institution to always look at Loans > History before running a Bankruptcy transaction. If an ACH payment has posted earlier that day, you will need to make a decision, such as the following:

Here is an example of Loan History showing an ACH payment and then a bankruptcy on the same day:

Loans > History Screen > Detailed History Tab

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

I like to think of a General Ledger system as a mini-bank…or a giant piggy bank with lots of different slots. Did you ever have one of those saving...

Did you know that our software supports lending institutions that during the busiest season of the year have been known to write checks for more than...

Did you know that you could save millions by switching to electronic statements? That’s exactly what one of GOLDPoint Systems’ clients did. Our...