Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

Loan and delinquency statistics are important matrixes for lending institutions to track. Most managers prefer to have that information updated more than once a day, which helps them better steer the ship if they discover that the numbers are going the wrong way. Can you imagine a captain of a ship only checking the direction of the wind once a day? Of course not! Lending institutions have a similar need to chart the course for their success.

CIM GOLD, GOLDPoint System’s loan servicing application, has many useful tools for tracking loans and delinquencies. One of the most effective and well-used tools is the Loans Statistics and Summaries Statistical Summary screen, which is updated multiple times a day (sometimes as often as every half hour). This screen shows the total number of loan types opened, as well as the total number of those loans that are in various stages of delinquency.

This information can be customized and sorted by your institution’s business structure. For example, depending on how your institution is structured, you can view statistics by:

We can also set up this screen to show the exact types of delinquencies of each loan type your institution offers. For example, this screen can show the number of loans that are 30-days past the Due Date, 60-days past the Due Date, 90-days past the Due Date, number of loans that have been charged-off, number of loans that have been repossessed, or any other means your institution needs to view the health of your loans.

Why would this be helpful? Here are three good reasons why the Statistical Summary screen may be the most useful tool for your institution’s success, and if you aren’t using it already, you should be.

Because this screen gets updated regularly, you can quickly see which regions are having the most success opening loans or collecting on delinquent loans. It’s a good habit to look at this screen first thing in the morning and print the information. Or better yet, export it to an Excel spreadsheet. Then, at the end of the day, print or export the information again to see how well your institution did collecting on delinquent loans.

Why not make it a friendly competition? Everyone likes a good challenge. Using the Statistical Summary screen, it’s easy to track which divisions, regions, or branches are having the most success bringing accounts current.

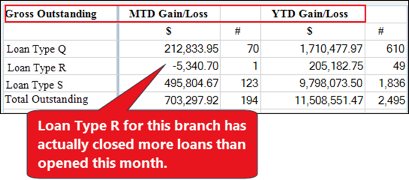

You could even request the Statistical Summary screen show the month-to-date and year-to-date gains or losses of loans, as shown below.

Then, using the sort feature at the top of the screen, you can view those statistics based on your institution’s structure, as shown in the following example:

-2.png)

Next, start checking everyday who is in the lead. Make a game of it. Give out daily, weekly, or monthly prizes, with an overall grand winner at the end of the year. And track it year over year to see continued progress.

This screen really embodies what the founder of our company, Bliss Crandall, built his whole company on 65 years ago: if you can’t measure it, you can’t manage it.

The underwriting engine used to designate loan applicant criteria can be a complicated process. Even with your best educated guess, you can never fully predict if borrowers will be great at making timely payments. The Statistical Summary screen can help you better assess the underwriting process.

If you start to notice one particular loan type has an above-average number of delinquencies, you may want to take a better look at how the borrowers were approved for the loan in the first place.

In the following example, you can see that Loan Type S loans have a very high rate of delinquency, especially compared to Loan Types Q and R. This institution may want to consider screening those applicants a bit better.

-1.png)

Using the Statistical Summaries screen, you can quickly see how many loans of one type are current compared to other loan types. You can also compare by region. If one region or loan type seems to be lacking, then the reverse of the bullet point in number 2 can occur—you can adjust your underwriting criteria to encourage more loans on your system.

This can also be said if delinquencies are healthy or relatively non-existent for a particular loan type. Perhaps your demographic could get a little wider. Only your institution (and government regulations, of course) can determine how wide a net you need to cast to attract more business.

GOLDPoint Systems prides itself on the customizability of its products, and the Statistical Summary screen is one of the best examples. This screen is designed for the specific needs of each institution, and no two clients use it exactly the same way. If you want to make use of this screen, you will work closely with your GOLDPoint account representative to:

We want to help this screen be your institution’s secret to success. Contact us today to learn more!

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

Good job, America! For the past 8 years, the average credit score for Americans has improved. It’s a great indicator of a good economy.

For my kids’ school lunch program, I have a debit card on file in their online payment portal that debits my card $30 every month. I hadn’t looked at...

According to the Federal Reserve’s recent consumer credit report, US consumer debt rose in October by the most in 2018, indicating that Americans are...