Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

2 min read

Charles Burnett

:

January 6, 2023

Charles Burnett

:

January 6, 2023

2022 was a big year for GPS and its clients. Bigger and bolder steps were made towards our all-Web future. In the meantime, we serviced a ton of loans and made our institutions a ton of money. It’s evident that 2023 is shaping up to be a productive and lucrative year!

In continuing an annual tradition, we combed through last year’s Update and What’s New releases to list the biggest and best development highlights made possible by GOLDPoint’s hardworking employees in 2022. Follow the links below, check out the Help Center or talk to your account representative for more information about the new features and options listed here.

Several new applications were added to the App Portal this past year:

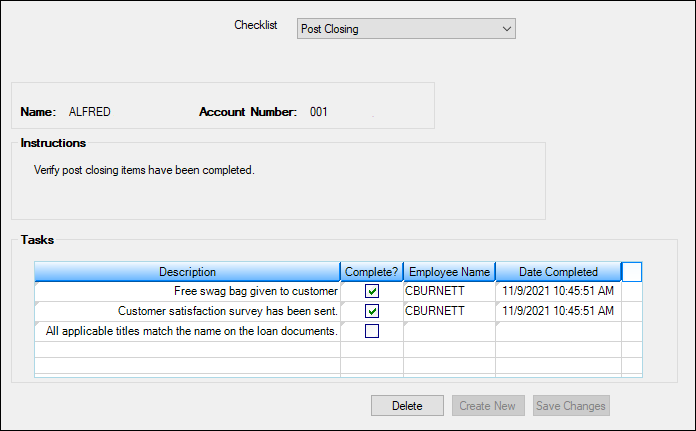

New screens have been added to CIM GOLD to further diversify your options in servicing customer accounts:

New institution options have been programmed as we continue customizing our system to fit our clients’ needs:

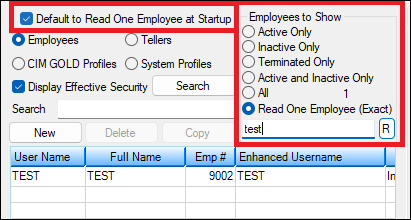

Not every change is as grandiose as a new screen or program. Sometimes, all a client needs is a new field or option:

We hope everyone reading this has a productive and fulfilling 2023. If your institution is interested in any of these new features or can think of an entirely new one that would attend to your specific needs, reach out to your GOLDPoint account manager and let’s discuss it!

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

2023 was a big year for GPS and its clients. We continued the march towards our all-Web future, servicing a ton of loans and making our client...

At GOLDPoint Systems (GPS), we are constantly improving our products to meet the needs of our clients and an ever-innovating industry. We pride...

At the end of 2018, a record 7 million Americans were 90 days or more behind on their auto loan payments. What does this mean for lenders? It means...