Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

Over the past few years, Equifax has undergone a complete transformation to become the only cloud-native consumer credit reporting agency. With this transformation have come vast changes to Equifax’s technology and security infrastructure. It has also brought changes with how the Equifax Cloud™ communicates with other companies.

One notable change in communication is the switch to using a JSON/HTML credit pull instead of a Text/HTML credit pull. As Equifax moves forward, their company will no longer be supporting Text/HTML credit pulls so switching to a JSON/HTML credit pull will be the only way to receive credit scores and credit reports from Equifax.

This is pretty big news for those of us in the consumer lending industry. But no worries, GOLDPoint Systems is always ready to adapt.

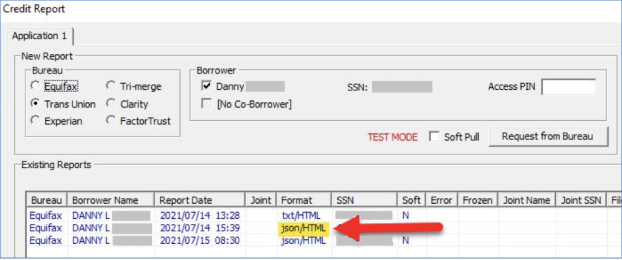

To keep up with Equifax’s new moves, we are updating GOLDTrak PC to pull credit using a JSON/HTML credit pull. Once this update is released, you will simply need to download an upcoming version of GOLDTrak and the system will automatically begin using a JSON/HTML credit pull. While this credit pull will be happening in the background, you will be able to see that this type of pull is occurring in the Format column on the Credit Report screen (see below).

While that little change on the screen may seem small, underneath it’s a huge transformation. And it means that your company will still be able to pull credit from Equifax. So that’s cool.

If you’re using our Automated Decision Engine to automatically and seamlessly perform underwriting for your loans, you’ll be interested in our new Credit Pull API trigger. This new trigger allows your company to add a credit check (soft or hard) to the Automated Decision Engine. Adding a credit check within our Decision Engine saves loan officers from verifying an applicant’s credit worthiness. Think how much time that saves.

Plus, our new Credit Pull API trigger obtains an applicant's full financial profile. (That’s some serious information.) And then the Automated Decision Engine can use that information to determine whether to approve a loan or not. If the applicant has a low credit score, you can decide whether to send the application to a loan officer for further review, or to immediately deny the application. It can also use credit scores to set interest rates. It’s quite beautiful really.

And one of the best parts, our new Credit Pull API trigger uses a JSON/HTML credit pull, which means it’s totally ready to communicate with Equifax and that new Cloud of theirs.

-Sep-02-2021-03-39-07-77-PM.png)

Equifax’s move to the Cloud has been huge and it shows that they are a company staying ahead of the game. GOLDPoint Systems can help your company do the same. We offer the latest technology and keep track of changes in the lending sphere so we are always at the forefront.

Want to learn more about GOLDPoint Systems and how we can help your company thrive? Visit our website or schedule a free demo.

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

I know you’ve been excited since reading about Equifax’s Big Move in my last post. And you’ve been wondering when all the changes on our end were...

GOLDPoint Systems automatically sends a transmission to the credit repositories each monthend detailing account activity. We can send transmissions...

At GOLDPoint Systems (GPS), we are constantly improving our products to meet the needs of our clients and an ever-innovating industry. We pride...