Amortization Deep Dive: The Rule of 78s

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

Unfortunately, not every borrower at your institution will keep up with their payments. Some of them may even fall behind enough to land themselves in delinquency status. When that happens, collectors need to step in and protect your investment, and the best tool to assist them is a collection queue.

Further reading: Measuring Loan Delinquency

Collection queues are lists of loan accounts determined to be delinquent by your institution’s specific criteria. These lists are generated in the afterhours and assigned to collection employees through our loan servicing software (CIM GOLD). Once your institution gets its collection queues set up, your employees will find numerous features provided to streamline the collection process, including:

The process of setting up collection queues can be a little complicated. Fortunately, GOLDPoint Systems account representatives and DocsOnWeb are always available to guide you. Your institution’s administrators can use the Queue Administration screen in CIM to set up the particulars of your collection queues, including:

Once all the hard behind-the-scenes work has been done, your collections employees will be able to efficiently work through their queues with a minimum of supervisor intervention. With the proper setup, the collection process can be as simple as the following example:

If your institution isn’t currently using collection queues to organize and streamline the collection process (or if you think you could utilize collection queues more effectively), contact your GOLDPoint account manager to learn more. Also, remember that GOLDPoint prides itself on the customizability of its products. If there is additional functionality your institution would like to be added to our Queues system, we would love to discuss it with you.

For more information, see these other topics:

As we talked about previously, there are many reasons why understanding amortization methods is helpful for financial professionals. Today, we’re...

In today's digital age, where online banking and electronic communication have become the norm, ensuring the security of financial information is...

If you spend any amount of time looking over GOLDPoint Systems documentation, you’ve probably come across the term GILA Loan once or twice. But what...

Probably one of the hardest jobs at your institution is that of a collector. Working with the public can be highly stressful, especially with a job...

Lending institutions have a vested interest in the condition of collateral tied to loans. If the collateral is damaged to the point it isn’t worth...

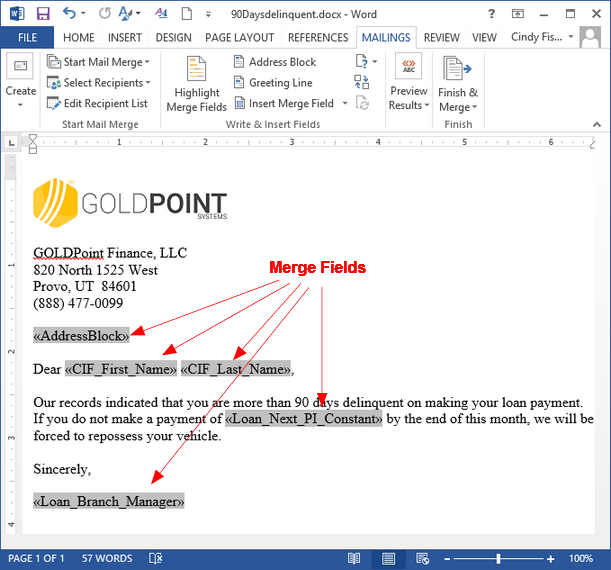

Mail Merge letters are an important part of collection efforts. If an employee can't reach a borrower through calling or texting efforts, they can...